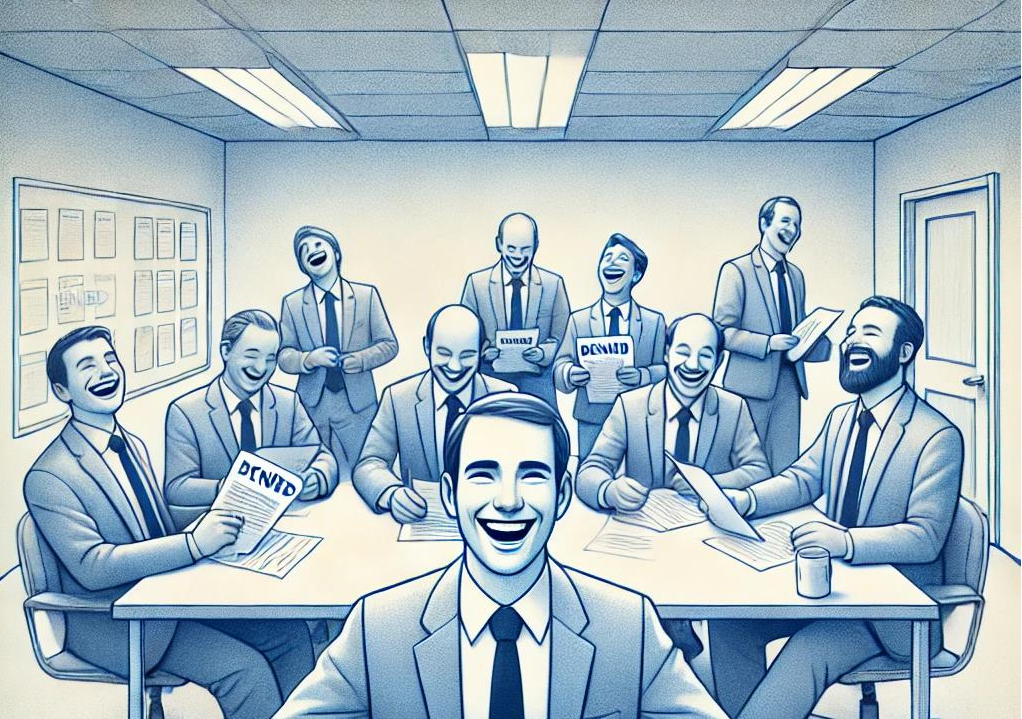

At Collins & Collins, P.C., we believe that insurance companies should be held accountable when they act in bad faith—that is,

when they wrongfully deny or delay legitimate claims, leaving policyholders without the coverage they are entitled to.

Unfortunately, bad faith practices are all too common in the insurance industry, with massive corporations often prioritizing their

profits over the well-being of their policyholders. When these companies exploit individuals during their most vulnerable

moments, our firm steps in to fight for justice.

What Is Insurance Bad Faith?

Insurance bad faith occurs when an insurance company fails to fulfill its contractual obligation to act fairly and in good faith

toward its policyholders. This can take many forms, including:

• Unjustified Denials: Refusing to pay out on valid claims without a reasonable basis.

• Delaying Claims: Intentionally dragging out the claims process, leaving policyholders in financial distress while waiting for

payment.

• Underpayment of Claims: Offering settlements that are far below what is owed, forcing claimants to bear the financial

burden.

• Failure to Investigate: Refusing to properly investigate a claim, resulting in wrongful denials.

When insurers engage in these practices, they violate the trust of their policyholders, who have faithfully paid premiums with the

expectation that they will be protected in times of need. At Collins & Collins, P.C., we know how to hold insurance companies

accountable for these abuses, ensuring that our clients receive the compensation they are rightfully owed.

Medical Insurance Bad Faith: Particularly Egregious and a Litigation Focus for Collins & Collins

Of all the types of insurance bad faith practices, medical insurance bad faith is among the most egregious. These practices often

lead to devastating consequences for individuals and families because the denial of critical medical care can have life-threatening

outcomes.

Collins & Collins, P.C. has made the fight against medical insurance bad faith a key focus of our litigation efforts. We take these

cases seriously because medical insurers, some of the largest and wealthiest corporations in the world, are exploiting individuals

when they are at their most vulnerable—sick, injured, or facing a serious health crisis. In many cases, these companies deny

necessary treatments, delay approvals, or underpay for care, all to protect their bottom line.

Why Medical Insurance Bad Faith Is So Dangerous:

Denial of Life-Saving Care: Wrongful denials of coverage for surgeries, treatments, or medications can lead to severe health

complications, permanent injury, or even death.

• Delays in Treatment: Insurers often delay approvals for essential medical procedures, forcing patients to wait while their

conditions worsen.

• Manipulative Practices: Medical insurers may require unnecessary prior authorizations or claim that treatments are

“experimental” or “not medically necessary” when, in fact, they are essential to the patient’s survival.

Our firm is especially motivated when medical insurers deny coverage for children. When these powerful companies put a

person’s health at risk to avoid paying for necessary care, we take immediate and aggressive action. No family should be forced to

endure financial ruin or the loss of a loved one because an insurance company refuses to live up to its promises.

Other Types of Insurance Bad Faith:

While medical insurance bad faith is a particular focus for our firm, we also represent policyholders in a wide range of bad faith

cases, including:

• Disability Insurance: Wrongful denials of long-term or short-term disability claims can leave individuals without income

when they are unable to work due to illness or injury.

• Life Insurance: Insurance companies may refuse to pay out life insurance benefits after the death of a loved one, leaving

grieving families to fight for what they are owed.

• Auto Insurance: Insurers may underpay or deny valid claims for vehicle damage or injury following an accident, forcing

policyholders to cover the costs themselves.

Why Choose Collins & Collins, P.C.?

At Collins & Collins, P.C., we are not afraid to go head-to-head with large insurance companies. We are in the business of holding

institutions, the government, businesses, and corporations of every kind accountable for the harm they cause to individuals. We

get particularly motivated when the person harmed is vulnerable—especially when a child’s health or safety is at risk—and the

institution tries to escape responsibility.

Our team has a deep understanding of how insurance companies operate, and we know the tactics they use to deny or delay valid

claims. We have successfully represented clients in complex bad faith cases and are committed to getting results for individuals

and families who have been wronged.

Contact Us for a Free Consultation

If you or a loved one has been the victim of insurance bad faith, contact Collins & Collins, P.C. today. Our team will thoroughly

review your case, help you understand your rights, and take action to recover the compensation you deserve.